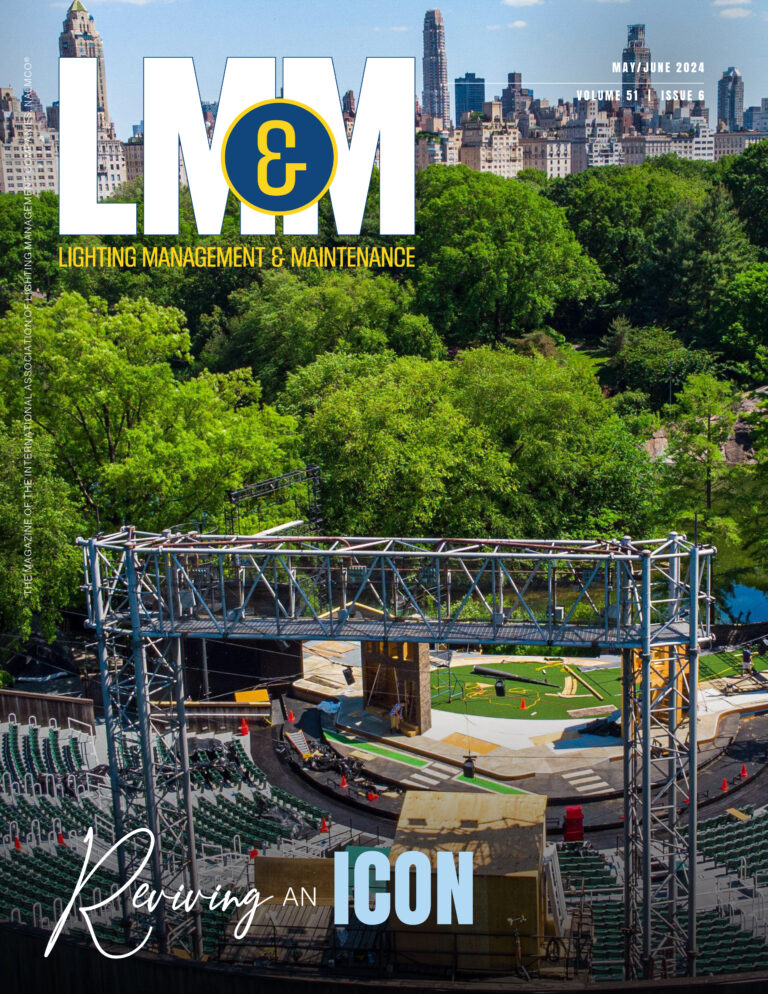

In late May, LumenOptix Founder Jay Goodman (third from right) and Northeast Regional Manager David Errigo (second from right) posed with (left to right) Patrick Hughes (NEMA), Keith Cook (Philips), Stephen Rood (Legrand), and Joseph Eaves (NEMA) in front of the office of Congressman Aaron Schock of Illinois’ 18th District as part of a delegation to lobby for the extension of the federal Commercial Building Tax Deduction (Section 179D)”

Participates in NEMA delegation to promote reinstatement of Section 179D

(Montgomeryville, PA – June 16th, 2014) LumenOptix, a leader in innovative luminaire design for the built environment, was among the key manufacturers assembled in Washington, D.C. in late May as part of a delegation formed by members of the National Electrical Manufacturers Association (NEMA) to lobby for the extension of the Commercial Building Tax Deduction, also known as Section 179D. As part of the NEMA-led team, LumenOptix worked alongside representatives from fellow NEMA High-Performance Building Council members Philips and Legrand to lobby for the update of Section 179D with legislators who champion this landmark federal tax code.

A provision of the Energy Policy Act of 2005 and the nation’s first performance-based federal tax incentive aimed at driving energy efficiency improvements in commercial buildings, Section 179D was successful in promoting upgrade activity among the nation’s 5+ million commercial buildings but officially expired on December 31st, 2013. Prior to its expiration, Section 179D allowed for a tax deduction of up to $1.80 per square foot for buildings that achieved a 50% reduction in energy and power costs relative to a baseline building under the ASHRAE 90.1-2001 standard. New legislation known as the “Energy Efficiency Tax Incentives Act” (S.2189), introduced by Senators Ben Cardin (D-MD), Dianne Feinstein (D-CA), and Brian Schatz (D-HI), proposes to extend and modernize the Section 179D deduction by creating scaled incentives of up to $3 per square foot to further encourage energy improvements in existing buildings; the legislation would also enable private and non-profit building owners to allocate deduction amounts to other parties who are associated with or benefit from retrofit projects, such as designers or building tenants.

“Many customers of ours and our industry peers, from small businesses to conglomerate-sized players, have used the Section 179D tax deduction for payback and savings calculations and it’s proven to be a powerful tool in selling energy-saving retrofit projects,” confirmed LumenOptix founder Jay Goodman, an over 25-year veteran of the lighting industry, of his and the NEMA-led team’s efforts to lobby for the reinstatement of the provision under an extender bill. “In addition to boosting sales of all energy-efficient products within the building envelope, helping commercial buildings to enjoy significant operating cost reductions, and enabling the nation to achieve a greater level of energy independence and global competitiveness, the extension of the commercial building tax deduction is expected to create 77,000 new U.S. jobs within two years of enactment, which is a tremendous win-win for American economic growth and employment.”

According to Joseph Eaves, NEMA’s Director of Government Relations, manufacturer participation in NEMA-led initiatives on Capitol Hill is an important process. “NEMA and members like LumenOptix understand how important it is to educate our elected officials about public policy, and our recent meetings regarding Section 179D provided NEMA members the opportunity to build important relationships and relay to staff how their businesses have been affected by this policy,” said Eaves. “It’s one thing for staff to theorize about what policy ‘might’ do and another to hear real-world examples of how policy actually impacts business. NEMA commends LumenOptix and others for proactively pursuing the opportunity to speak on behalf of the entire industry at the legislative level and help influence and drive policy improvements that will benefit both the industry and our nation.”

As the manufacturer of such high-efficiency innovations as its family of Retrofit Downlight Luminaires (LRDs), which enable a commercial or institutional downlight of any make, model, or size to be upgraded in just minutes to energy-efficient, maintenance-free LED technology, as well as the one-piece “LER” LED upgrade solutions ideal for recessed lay-ins within the already-built environment, LumenOptix stands alongside over 50 other manufacturers and organizations – including the Alliance to Save Energy (ASE), the American Council for an Energy-Efficient Economy (ACEEE), the American Institute of Architects (AIA), and the U.S. Green Building Council (USGBC) — in support of the extension of Section 179D.

“Through our team efforts to secure the extension of Section 179D, LumenOptix is proud to help drive a more energy-efficient future and to lobby for an outcome that will benefit not only our industry and the nation’s commercial buildings, but most importantly America’s economy by creating essential manufacturing jobs, particularly in the critical small business sector,” Goodman concluded. “We hope that Congress will see the incredible benefits and positive ripple effect that an investment in American business will have on the entire supply chain.”

About LumenOptix, LLC

Based in Montgomeryville, PA, LumenOptix leverages precise optical and luminaire design to create lighting solutions that provide optimal light levels and maximize energy savings. Driven by a dedication to outstanding

quality, performance, and customer service, the company’s products are proudly manufactured in the United States and deliver the utmost in true specification-grade energy saving solutions for the retrofit needs of the lighting market. For more information, contact LumenOptix at (800) 671-6799 or visit www.lumenoptix.com.

About NEMA

NEMA is the association of electrical equipment and medical imaging manufacturers, founded in 1926 and headquartered in Rosslyn, Virginia. Its 400-plus member companies manufacture a diverse set of products including power transmission and distribution equipment, lighting systems, factory automation and control systems, and medical diagnostic imaging systems. Total U.S. shipments for electroindustry products exceed $100 billion annually.