In Friday’s investor call with Eric Rondolat, Signify’s CEO, the company’s current internal reorganization and its impact on sales and market growth were highlighted. During the call, an analyst from JP Morgan inquired about the organic sales decline, which exceeded expectations, and whether the reorganization efforts hindered the company’s ability to fulfill commitments or orders.

Earlier on Friday, we published Signify’s Q1 Earning Report: Signify Q1 Nominal Sales Drop of 12.5 %, Stock Drops 11%

Rondolat addressed the concerns head-on, explaining that the reorganization did not significantly affect the company’s customer-facing teams. These teams remained constant throughout the process, suggesting that the reorganization should not have affected the company’s ability to maintain its customer relationships and, by extension, its order fulfillment capabilities.

An unanticipated downturn in the Professional Lighting business in Europe exacerbated this decline, with trade sales falling short of expectations. While this downturn appears structural and indicative of broader economic issues, particularly in Germany, Rondolat expressed optimism that it was temporary.

Regarding the backlog in the Professional business segment, Rondolat acknowledged a decrease compared to previous quarters. Despite this, the company’s backlog remained robust in OEM and Conventional segments.

Martin Wilkie from Citibank inquired about the status of stocking levels in both the OEM and Consumer segments, inquiring whether destocking activities had concluded and assessing the impact of these actions on the company’s financials.

Rondolat acknowledged that OEM inventory levels have normalized, with a significant reduction from a peak of 21 weeks to six weeks in the Americas, and from 15 to five weeks in Europe. This substantial reduction implies a period of overstocking, coupled with a market lacking strong dynamics, created a double-edged challenge for Signify.

On the Consumer side, destocking was less severe due to a better-performing economy during the period of inventory adjustment. With a more direct correlation between selling in (stocking) and selling out (sales to end customers) now evident, Signify sees this as a positive trend, especially as Connected business segments are witnessing growth.

Wilkie also inquired about the potential impact of destocking on pricing, whether it necessitated any discounting to move inventory. Rondolat clarified that the destocking primarily affected volume, not price, indicating that the company managed to maintain its pricing integrity despite the need to clear excess inventory.

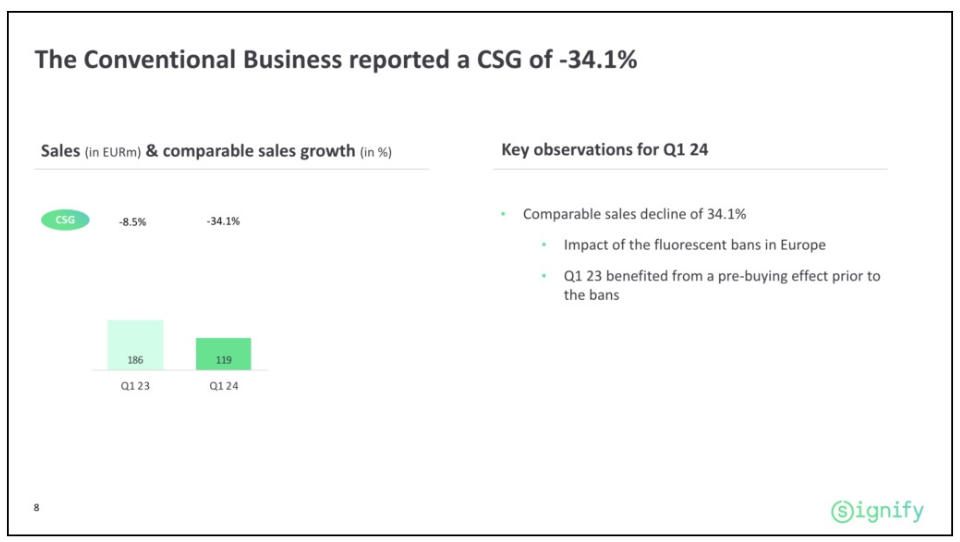

An unknown analyst inquired whether the company was still outperforming others in selling legacy products. Rondolat said the sales decline in Conventional is pretty much linked to the good performance of Conventional last year. He explained that some legacy technologies were being banned and customers were buying them up before they disappeared. This made the prior year look strong, causing the current year to seem worse in comparison.

Rondolat mentioned that while they don’t usually share margins by segment, they can say that they’re not doing any worse in Conventional products. He assured more detailed information would be provided before the Q2 earnings call.

An analyst from ING queried about the company’s notably strong gross margin, which had reached 41%, surpassing the typical 39-40% range. He questioned whether the company intended to leverage this higher margin to reduce prices and stimulate growth, and how this might evolve in subsequent quarters.

Rondolat explained that the company’s gross margin expansion in 2024 was a result of deliberate price increases and cost reductions achieved in 2023, which improved the gross margin by approximately 210 basis points. The trend is expected to continue, characterized by stable pricing and ongoing cost savings.

He elaborated that, while the Conventional business experienced positive pricing effects, the Consumer business remained stable, and the OEM and Professional segments faced some pricing pressures. Despite these challenges, the company maintained an expanding gross margin, projected at 41.2% for the quarter.

Rondolat clarified their stance on adjusting prices to increase sales volume, stating that in a declining market, reducing prices is not an effective strategy to boost volume. This tactic is reserved for times of market expansion.

In a follow-up question about the Consumer connected segment, Rondolat confirmed that the market is showing signs of recovery. After two strong years post-COVID-19, followed by a period of market correction and increased competition, the Connected business appears to be poised for growth. The entry of competitors is seen as a natural consequence of a rapidly expanding market, and the company is optimistic about its prospects in this segment.

Another analyst asked about the stronger performance in the U.S. compared to Europe. Rondolat pointed out that the boost was particularly notable in indoor environments, with Cooper Lighting Solutions, known for its focus on indoor applications, performing exceptionally well. He also mentioned that projects across small, medium, and larger scales were advancing successfully. Rondolat highlighted the company’s effective pricing strategy and the consequential increase in both gross and profit margins. While outdoor projects, including street lighting, faced delays, often due to slower-than-expected disbursement of funds from incentive programs, Rondolat remained positive about the segment’s performance.

Adam Parr from Redburn Atlantic queried about the status of horticultural orders in the first quarter and their potential for growth in April and beyond.

Rondolat indicated that the first quarter is typically a slow period for the horticulture sector due to its seasonal nature. He mentioned a significant uptick in order intake, signaling a recovery from the losses experienced at the end of 2022 and early 2023, which were attributed to the high cost of energy. Rondolat outlined that the horticulture market typically commits in Q1 with the bulk of delivery and revenue recognition occurring in Q3. He projected that Q3 would be a substantial quarter for the horticulture division, contributing to the overall growth of the company. This recovery in horticulture is expected to be complemented by improvements in the Consumer and OEM businesses, alongside the steady performance of the U.S. Professional segment.

Listen to the investor call here.